|

|

|

|

|

||||||||||||||||||||||||

|

Other tools available:

|

||||

|

CASH FLOW FORECAST

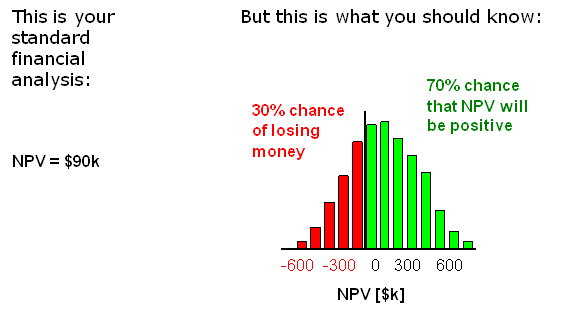

Estimate income and cash flow projections, identify most relevant drivers of cash flows, model uncertainties using Monte Carlo simulation |

OPTIMAL SUPPLY ESTIMATOR

Identify optimal order or production quantity to maximize contribution margin, model uncertain demand and price with Monte Carlo simulation |

LEASE-OR-BUY CALCULATOR

Calculate total cost of leasing and buying using discounted cash flow analysis and net present value, model ad hoc scenarios across many parameters |

||

|

|

||||